Beautiful Tips About How To Fight Overdraft Charges

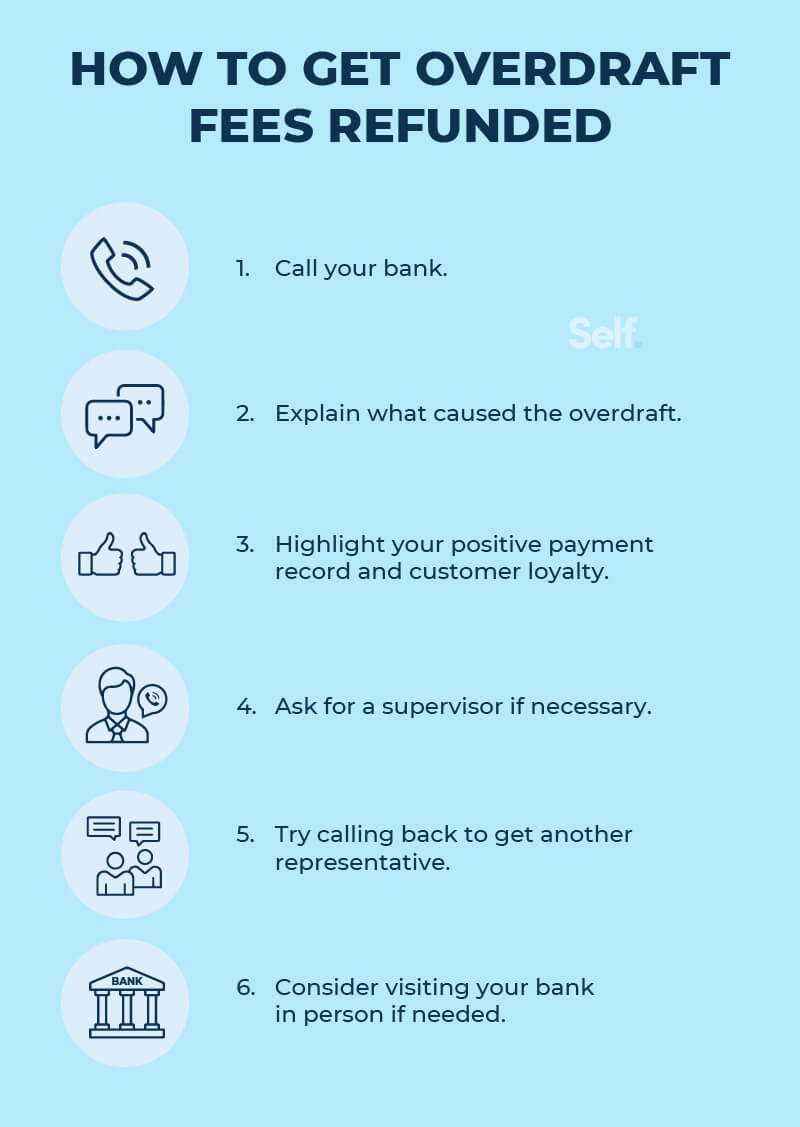

Start by calling up your bank and politely asking to have the fee waived.

How to fight overdraft charges. A savings autotransfer is an automated transfer of funds from your savings account to cover overdrafts in your checking account. Use donotpay to help you manage your overdraft fees. Explain the circumstances that caused the problem.

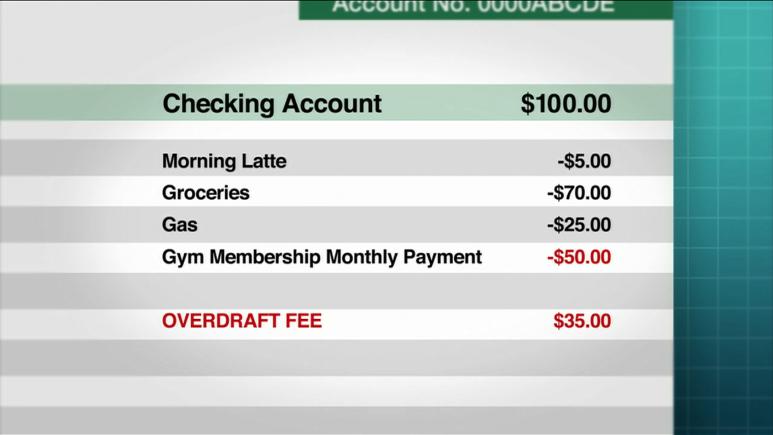

If you want to get us bank overdraft fees eliminated, but don't know where to start, donotpay has you covered in 4 easy steps: As such, it is advisable to get to the root of the matter. Now the consumer financial protection bureau asks how much of that was bad money.

Often, a teller or customer service representative. The fight over overdraft fees banks recently made huge profits from overdraft fees. Call the bank customer care.

How to avoid overdraft fees. Call the bank's customer service representative or manager and politely ask to refund the fees. But with so much confusing government legislature surrounding overdraft fees, many customers do not know that they can appeal against an overdraft fee and fight to claim it back.

Human interaction is the most important part of trying to get overdraft fees refunded. Visit with one of our. Ask to speak to the account manager if the person you speak to says that he cannot help.

Regardless of the barricades your bank representative might put up to deny your request for a. If you do unintentionally use your overdraft, call the bank as soon as you realize to discuss the charges. There are a variety of ways you could try to get overdraft fees refunded, such as:

.jpg)

/overdraft-4191679-FINAL-ced43d559c6e4b909fe775200cb5acc3.png)