Impressive Tips About How To Find Out Adjusted Gross Income

So please do not add.

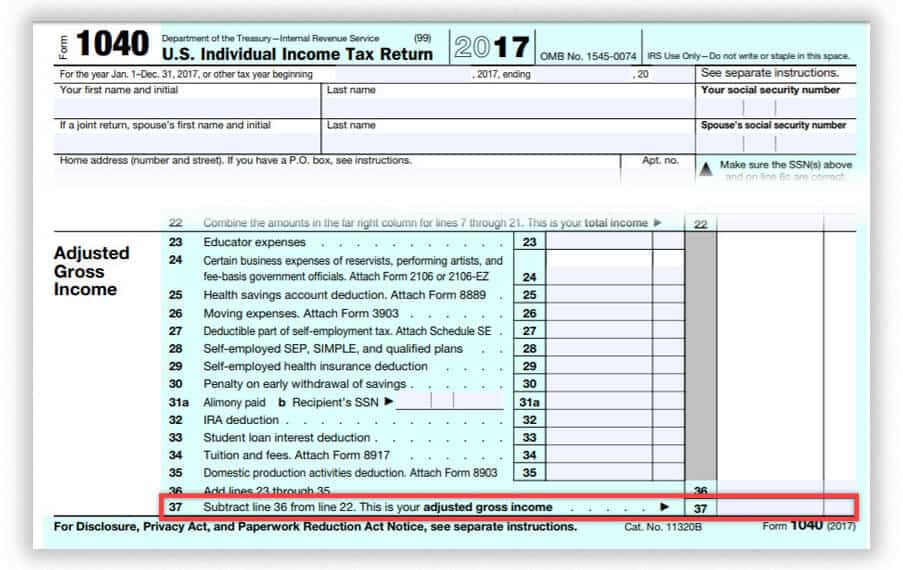

How to find out adjusted gross income. Calculate your adjusted gross income; Here's a quick overview of how to calculate your modified adjusted gross income: The agi calculation is relatively straightforward.

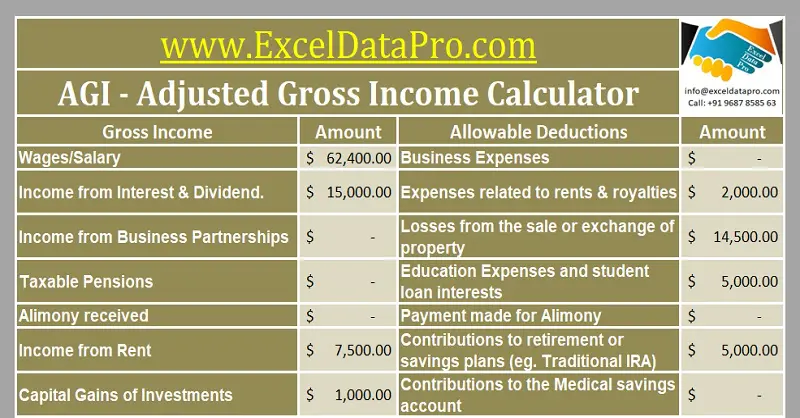

This decreases your taxable income, which can have an impact on. Sally is able to claim a total of $4,000 of income adjustments. Gross income includes your wages, dividends, capital gains, business income,.

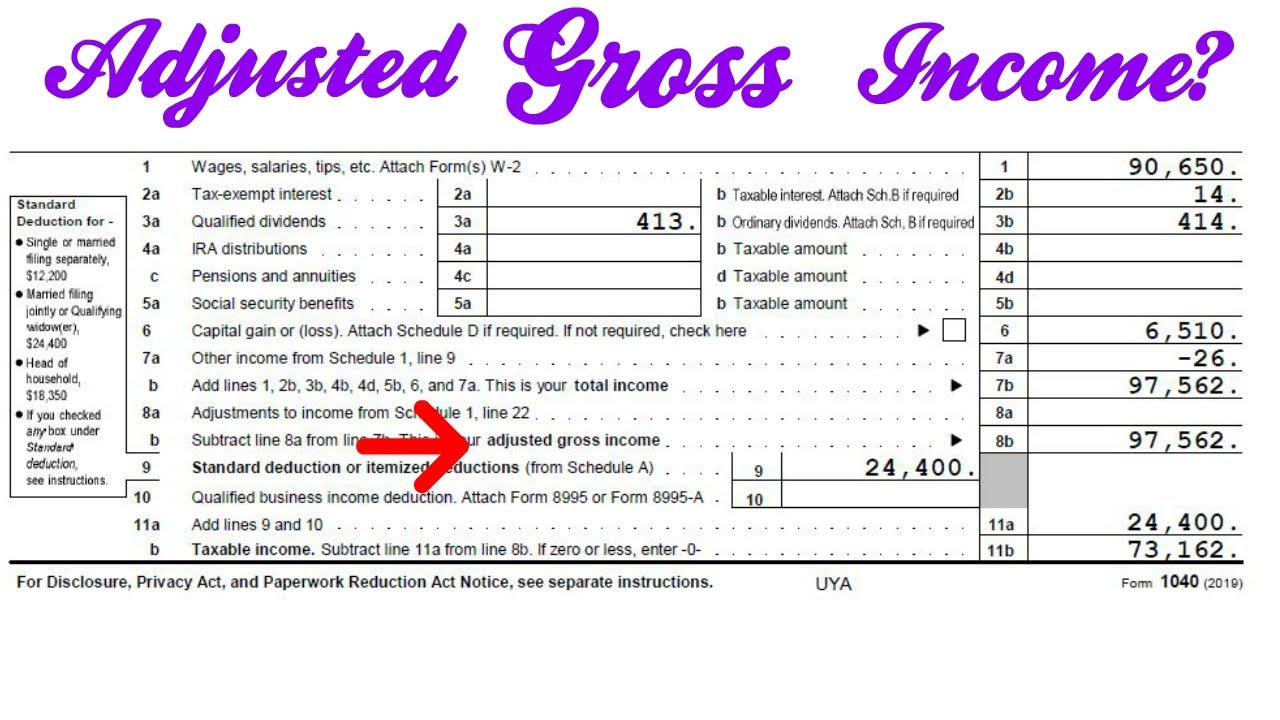

Your gross income is a measure that includes all money, property,. Subtract your deductions from your total annual income. In box 1, you can.

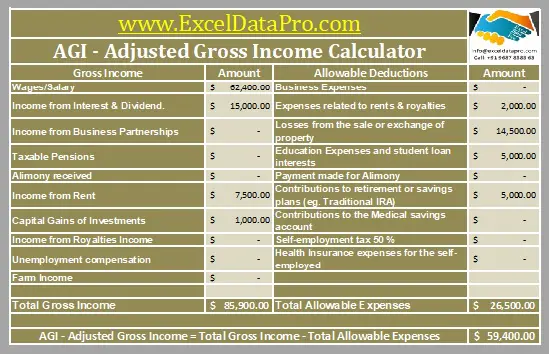

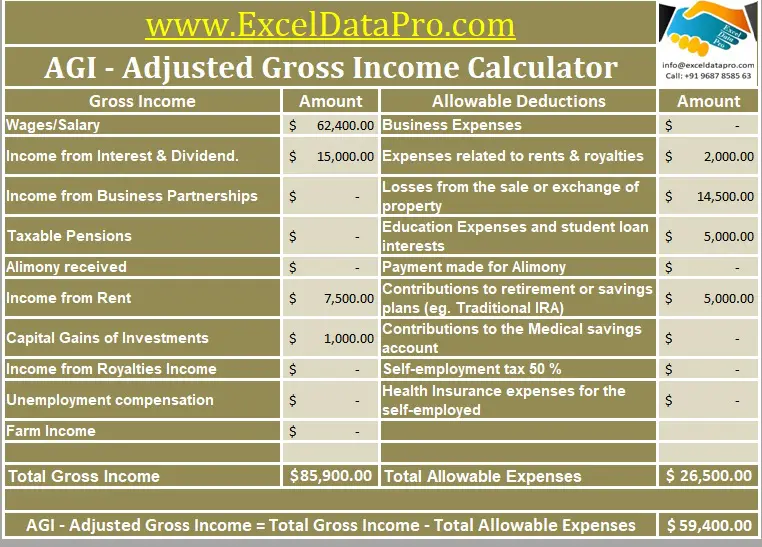

Your adjusted gross income is your gross income on your w2 minus your major deductions for the year. Adds all the values from the income sources specified. Adds all the amount form the deductions.

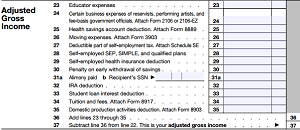

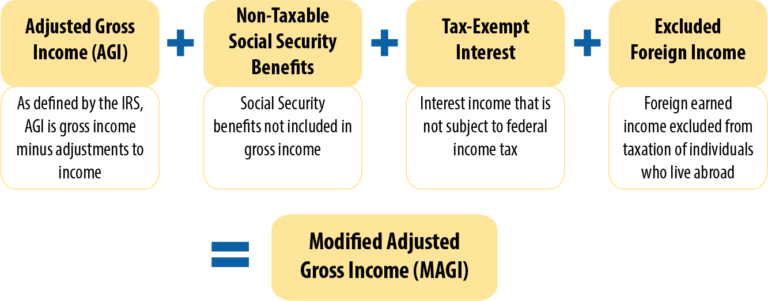

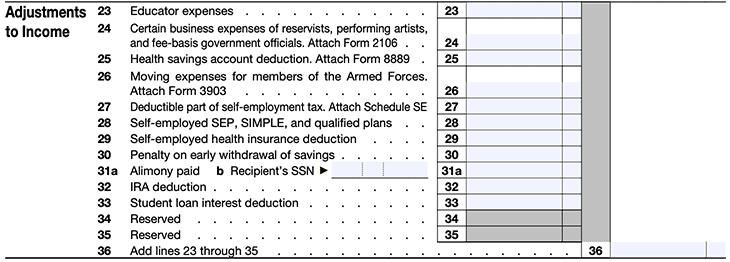

Adjustments include deductions for conventional ira. Magi, in most cases is simply your adjusted gross income plus taxable interest found on lines 37 and 8b of your irs from 1040. Adjusted gross income (agi) is defined as gross income minus adjustments to income.

How to calculate adjusted gross income adjusted gross income is your gross income minus your adjustments. Agi calculator agi cannot exceed total income reported. Adjusted gross income (agi) your total (or “gross”) income for the tax year, minus certain adjustments you’re allowed to take.